After studying philosophy and history, Ulrike Herrmann completed a training in banking and since 2000 has worked at the taz, the Tageszeitung or „daily paper“ in Berlin. Writing on social and business-political themes, her first book was published in 2010 and was followed by a succession of four other books all of which deal with the political-economic development of Germany during the twentieth century with an emphasis on the post war years and the crisis currently faced by capitalism due to the world’s climate, resources and ecosystems no longer being able to supply what is demanded. Although only available in German, her latest book, The End of Capitalism – why Growth and Climate Protection are incompatible and how we will live in the Future, has become a best-seller and is such that it could be translated and without further adaptation, sold to large numbers of readers on both sides of the Atlantic.

Capitalism is the institutionalised lending of money so that companies, nations and concerns can raise money, so as to enable investments and innovation to be realised through shareholders who invest in the expectation that the bonds and stocks issued will pay an income whilst at the same time rising in value. As Philipp Blom points out in his What is at Stake (summarised in the Philipp Blom article) this concept was born in Holland in 1602, when the first stock exchange was founded so that money could be raised for the financing of trading ventures in India and the Far East. Where investors had the chance of buying into the trading ventures of merchants, the latter found a place where their ideas could be presented for consideration by a free market instead of having to appeal to the whims of a king or noble in order to raise money. Capitalism offers the chance that, through wealth already acquired, money may be invested so that more wealth may be generated on a scale that is profitable both for the investor and for the those in the concern that is being invested in. As the possibilities offered by technology quickly enter the picture, unlike Blom, Ulrike Herrmann sees capitalism as starting in 1764, with the invention of James Hargreaves‘ Spinning Jenny.

Underling her stance, she points out that although a developed system of banking was available in England during the eighteenth century, this was not drawn upon and the mechanisation of spinning and weaving was a series of family-financed, home-grown affairs that were not dependant on large loans or on the benefits of education. Typifying the situation was Hargreaves who couldn’t read and write and who made his Spinning Jenny using only the most basic tools. The reason why the Industrial Revolution started in Britain Herrmann suggests, was due to the relatively high wages that British workers enjoyed so that there was a strong motivation for experimenting to see whether mechanisation would be able to cut costs. Where stocks and shares are for companies, banks do much the same for private individuals and so capitalism becomes embedded in all levels of society and aspects of life. In the case of a farmer who borrows from the bank so that he can invest in machinery and so increase productivity, the increased productivity is such that despite paying interest and paying back the money he has borrowed, the farmer is still able to benefit from having a higher income. This assumes however that he is able sell everything he produces. If there is a glut on the market, his income will fall. As increasingly more banks invest in farmers improving their farms and machinery, the chance of a glut arising thus increases. In such a case, the farmers concerned are forced to look for new markets and the same applies across the board to all manner of producers, manufacturers and service providers. In the wake of World War II, the opening up of European markets was an important factor by which the United States was able to justify its repeatedly helping out and preventing European economies, particularly the German economy, from financial crisis and collapse, with the famous Marshall Plan being just one instance. In her book, Germany – an Economic Fairy Tale – why it’s no Wonder that we’re Rich (only available in German), Herrmann shows that without the aid offered by both the United States and Germany’s immediate European neighbours, the „German Economic Miracle“ would never have happened. Moreover, not only was the recovery not a miracle, it was also by no means confined to Germany. Between the two world wars, as well as in the immediate aftermath, economic growth in Europe had been negligible. With the establishment of peace and security, from 1950 up until 1973, economic growth rose by a staggering 5% every year. While this sounds modest, it should be compared with the 2.8% by which global production has been growing up until recently and which has resulted in production doubling every 26 years. The reason that a 5% growth rate was possible, was Herrmann argues, due to European countries investing in technology which enabled the technologically backward continent to catch up with the United States. Here it is important to stress that growth was aided and abetted by ever more countries joining the European Economic Community, this opening up new markets within Europe, for the increasing levels of production that technology enabled. Yet once the European Union had expanded as much as it could, a lack of markets once again became apparent, so that Thatcher and Reagan were prompted to accelerate globalisation. Here the thinking was that while the West would gain new markets, the emerging countries and the countries of the third world would have increased trading opportunities, so that they would be able to generate their own wealth and so invest in themselves. That this did not happen is Herrmann argues, due to a Catch-22 situation caused by the fact that as the cost of labour is so low in third world it is not worth investing in machines. Accordingly productivity does not rise and so wages remain low with the countries concerned remaining trapped in scenario of low wages and low productivity. Even though it was made of wood, Hargreaves‘ Spinning Jenny cost 70 times as much as a traditional spinning wheel. Once implemented in a society, technology become a major focus, driving force and cultural theme. Capable of opening up new markets within a society through new inventions, continual innovation and ever-changing design, technology is also capable of creating new markets through the ability of machines to make products increasingly faster so that people can afford things that they could not afford before. The new thus becomes important in itself and the future a dazzling prospect that is bought into both literally and through the through the belief that „in tomorrow’s world everything will be better“.

A scene from Charles Spencer Chaplin’s Modern Times (1930) in which a way through the confusing labyrinth of the modern is found

Akin to pulling oneself up by one’s bootlaces, capitalism has enabled the West to gain an unparalleled amount of wealth and every field of our lives is replete with innovations which make our lives easier and safer, whilst our spheres of operation are more wide-ranging than ever before. Behind these obvious innovations there are the supposedly more basic and yet ground-breaking important features of our lives, such as the welfare state. This can only be afforded by countries that, through capitalism, have accrued enough wealth so to be able to invest in a health service, a pension service and safety nets for the disadvantaged and those out of work. Socialism and Marxism (as traditionally interpreted – see below) are not alternatives to capitalism but are intended as correctives, aimed at ensuring a fairer distribution of the wealth that capitalism has already generated. Due to the inefficiencies of Soviet central planning, the economy of the USSR was not capable of growing and did not in any case aspire for markets outside the Eastern Block. In this sense it was thus doomed to failure from the start, with Glasnost and Peristroika being indirect admissions that the USSR could no longer economically underwrite its Eastern Block neighbors.

The problem with capitalism today is that a point has been reached where our demands for ever more of everything are exhausting the planet’s non-renewable resources and are pushing the ecosystems of its renewable resources towards a point of collapse. Many see this uncontrolled growth, as being in need of replaced by „green growth“, however in The End of Capitalism, Ulrike Herrmann argues this is illusonary and shows that, when examined in detail, the instances given of green growth are either just cases of green washing or, if implemented properly would result, not in growth but in a reduction of productivity.

To take just one of the many examples given, in the case of the automobile industry, it is widely held that e-cars, powered by green electricity, are the solution. Yet this ignores the carbon footprint of manufacturing a car and the fact that an e-car must travel 40,000 Kilometers before the environmental savings caused by its running on green electricity begin to kick in. All studies agree that there must be a reduction of the number of cars and as cars are on average, only used for one out of twenty-four hours, this would be a prime case where digital technology could be used so as to have a vastly reduced number of cars working as much as possible. In this way, self-driving e-cars could spend the whole time transporting people from A to B, enabling the carbon footprint of commuting to be dramatically reduced. Yet less cars would result not in growth for the automobile industry but in contraction and an unwanted shrinking. For those who see the era of growth as coming to an end, this is however precisely what is needed, with „de-growth“ being striven for rather than growth. Here some proponents argue from the point of view of preventing the divide between rich and poor becoming too crass, others are simply addressing the supply and demand problems of a world with limited resources, whilst yet others, like as Ulrike Herrmann, are concerned with the environment and the reduction of CO2 emissions. For Herrmann what is needed is a specifically tailored form of „green de-growth“. This is a vision of ecological recycling, which she sees as in the future, lying at the heart of every form of business. This means that everything produced is designed so that after its life-span has been reached, it can be completely re-cycled. The problem with all forms of de-growth is that putting the brakes on capitalism would initiate a recession, bringing unemployment, poverty and inflation. During the 1930’ies the desperation and helplessness that this caused, resulted in fascist ideologies being embraced that promised release from these evils and it is easy to see that this could happen again. The question is thus one of how to get from where we are now, to green de-growth, without long-term unemployment for millions of people and without widespread feelings of fear for the future. In The End of Capitalism, Herrmann draws a parallel with the British economy at the beginning of the Second World War. After the appeasement tactics of Chamberlin, Britain was utterly unprepared for war, with massively underdeveloped arms and munitions industries. The solution was to develop a new, centrally planned form of industry in which business remained in the private sector but what was produced, was dictated by the state, with the state distributing those goods that were in need of being rationed. Despite being centrally planned, the British model was very different to the systems operating in Stalin’s Russia and Hitler’s Germany. This Herrmann cites, not as a blue-print for a future economy but as an indication of how a transition model might look and as a demonstration that alternative economies are not only thinkable but are also possible and within their intended spheres of operation, have worked.

Apart from de-bunking the notion of green growth, Herrmann also debunks the value of taxes on CO2 emissions and of other forms of eco-tax where the revenue generated is not explicitly reserved for the environment and environment and energy related research. These fail to do any real good as, where the well and medium well-off pay more for travel, they do not pay so much as to be put off, whilst the poorer segments of society end up receiving a much welcomed bonus. The revenue generated is thus pumped back into the economy so that over time, as the changes are minimal, nobody sees any reason to amend their ways and no real reduction in CO2 emission is made. Making it abundantly clear where the problem lies and who is continuing to cause the lion’s share of it, Hermann points out that while a very small segment of people (the rich), leave exceedingly large carbon trails, the poor, who despite the fact that they vastly outnumber the rich, are responsible for only a tiny fraction of a society’s emissions. This however does not mean that those in between are made up for, or are somehow „not so bad“, they are still responsible for far more emissions that is either fair or than can be tolerated if a zero emission strategy is to be pursued. The same discrepancy reveals itself when national figures are compared, the rich nations are by far the worst offenders, whilst those that are poorest emit the least amount of CO2 whilst suffering the brunt of the consequences. Here it should be pointed out that the „brunt“ is all too often extreme poverty and the very real of threat of starvation. Proving that zero emissions are possible, is the fact that there is a not insignificant list of countries that already have this status – all be it because they never attained a rate of growth resembling that attained by the West and so never became as dependent on growth as we are. Herrmann also disposes of the hope that electricity made with solar panels in the Sahara can be used in northern countries such as Germany. Although this is possible, the cost of investing in cables and pylons make such a project utterly unrealistic. Similarly, splitting water with the electricity won in the desert to make green hydrogen which can then be transported, is feasible yet at every stage there are energy losses, so that the overall gain is not worth the investment. Likewise plans for filtering CO2 out from the air, whilst enticing, are marred by the difficulty of capturing the gas. This makes the filtering processes inefficient whilst the storage of the gas is replete with problems. These range from doubts as to the security of storage, to the speed at which secure storage can be achieved, which if not fast enough, is of no real help. Meanwhile, as governments have learnt, atomic energy is invariably accompanied by un-budgeted costs and all atomic power stations built recently have been completed with massively spiraling costs, completion dates years behind schedule and with the costs of decommissioning and waste disposal not included. A series of mini-atomic power stations, supposedly so different and so convenient, under construction in Utah follow the same trend with exploding costs and delays that mean the reactors won’t be feeding into the grid until 2030. The only working mini-reactors currently working are two adapted submarine reactors in vessels anchored in the North Polar Sea and which supply the Russian city of Pewek with electricity. These likewise only became operational through the injection of large amounts of un-budgeted money and for obvious reasons are highly controversial. As if the above arguments are not enough, there is the fundamental underlying objection that were the world consumption of fossil fuel to be replaced by atomic energy, then using current technology, the world supply of uranium would be exhausted in 13 years. Although other more efficient technologies are conceivable, they are not at present ready for use and the same considerations would apply to the use of radioactive substances other than uranium. Summing up, Herrmann observes that where the costs of generating electricity with solar panels has, for example, been spectacularly reduced, atomic power is the only form of energy where over the decades, the costs have continually risen and show no sign of not continuing to do so. Herrmann’s overall conclusion is that green energy is the only real option and while huge savings can be easily made, a real reduction of the amount of energy consumed by the West is unavoidable. Here she sees flying, all be it with green hydrogen, as being one of the unnecessary luxuries that will have to go. From a completely theoretical point of view, the argument that capitalism cannot go on forever is shown by the fact that the world can only support a limited number of people who accordingly, constitute a limited market. Although there is today still plenty of scope for new markets to be found and supplied, leaving aside the problems of energy, pollution and limited resources and ruling out future calamities, eventually there will come a time when the world’s population has no more new markets to offer.

In the case of the British industry at the beginning of the Second World War, the change-over from a peace-time economy to a war-time economy was successfully achieved through careful planning. Calculating what the war needed and what the civilian population needed if it was to clothed and fed, in order to see whether the economy cope with both demands, the British developed the concept of Gross Domestic Product (GDP) and rationed everything that was in short supply. In order to move from capitalism to green de-growth, an immense amount of planning will again be required. Although nowhere in the world have plans for green de-growth as such been announced, steps in this direction are being taken. The Kyoto Agreement of 2005 was based on a calculation of the amount of CO2 that the world’s population could emit without causing a rise in temperature that exceeded 1.5°C. This amount was then divided between the countries of the world according to population, to form a CO2 budget that with each passing year was consumed according to how much CO2 a country emitted. Where western countries use up their budgets quickly, other countries do so much more slowly. Thus where the German budget will be exhausted by 2035, the Indian budget will last for as long as 2090. This is because India only emits 1.9 tonnes of CO2 per person per year, whereas the Eurozone countries emit 6.5 tonnes per person per year. For different countries there are thus different dates by which it is agreed that they should reach a zero-emissions status. This is a nominal zero, as it is agreed that for each country, each inhabitant may emit one tonne of CO2 which does not count, as it is absorbed naturally by the environment. For Austria the deadline for zero-emissions is 2040, with the European Union as a whole aiming for zero emissions by 2050. Here the mechanism in place is a system of quotas known as the EU Trading System (EU-ETS). This was introduced in 2005 and currently applies to inter-European air traffic, the generation of electricity and industries that produce large amounts of CO2, such as the cement manufacturing industry. Taken together, these sectors are responsible for 40% of Europe’s CO2 emissions. The system works by stipulating that for each tonne of CO2 emitted, a yearly certificate is required. Although certificates can be bought, to ensure that production is not out-sourced, a certain amount of certificates are issued free. From 2026 onwards, the tonne of CO2 emissions covered by the freely issued certificates will however depreciate by 10% every year. Acknowledging that the Kyoto goals are insufficient and that stricter measures are imperative, the European Green Deal and „Fit for 55“ programms have sharpened these measures with a reduction of 61% by 2030 being aimed for and from 2034 onwards, there being no more free CO2 certificates in circulation.

Graph showing the rise in price of CO2 certificates from the year 2010 to 2022, with prices being below €20 a barrel from 2010 up until 2018. It is assumed that by 2030, prices will be between €100 and €150 a barrel

Towards the end of her book, Herrmann sketches out the implications of green de-growth as it will be registered by the world’s stock exchanges, nevertheless she does not go into the question of how stocks and shares will behave over the intervening years before the zero emissions days arrive. To avoid a crash on the stock market, the carbon emission performance of companies will have to made public so that companies with promising CO2 prospects can be seen as being favorable, whilst those with poor track records and those with only vague plans and no results will soon enough be seen as undesirable. Here the words „promising“ and „no plans“ are significant for they refer to expectations that may or may not be fulfilled in the future. This reaches to the heart of the matter of what a growth-orientated stock exchange is about. It is about the placing of considered bets on companies, on the expectation that they will perform well in the future. While there is no question that successful investment on the stock exchange requires a degree of skill and an ability to judge, as the future is not always predictable, there is also a degree of luck involved. This element of risk and the covering thereof (hedging one’s bets, from whence „hedge fund“) provides a further reason why the buying and selling of stocks and shares, invariably brings about a turbo-driven economy that has no choice but to continually expand and continually keep betting if it is to have a constant income. While all societies must believe that they have a future and so must in a sense bet on it, the difference between traditional societies and those in which there is a stock exchange, is that the on the stock exchange, the future is not just believed in as something that will come, it is quantified and quantified bets are placed on all manner of things. In this way everything is reduced to and perceived in terms of money and this is the ultimate underlying evil and the root of the problem. Relating the value of the shares of a company on the stock exchange to its carbon emission plans, changes this by shifting the emphasis onto the value life itself. Out of the fully justified fear of us rendering ourselves extinct (or at the very least destroying western civilisation) investors will soon enough be forced to consider a company’s green footprint and the credibility of its plans for reducing CO2 emissions on time. The genuine „green-ness“ of a company will thus become ever more important with share-prices reflecting this along with the yearly amount that company shares pay out in the form of dividends. Slowly that which was excluded – human value as opposed to monetary value – will resurface whilst what will go, will be the manic focus on growth in a future that is driven by a quantified need and expectation for ever more of everything in order to stay the same. On the stock exchange, this development can already be seen and ESG rating agencies judge the environmental, social and corporate governance aspects of companies. In the European Union, this emerging aspect of how things will be in the future, so-called „Green Finance“, is anticipated by a system of categories according to which investments are judged according to whether they contribute to a sustainable future or not. Not without controversy, this includes interim solutions such as gas powered and atomic power stations. These are however admitted on the condition that the former act as substitutes for less clean forms of energy production, and from 2035 onwards, operate with green gas. In the case of atomic power stations, a plan (that includes financing) must be submitted that outlines how atomic waste will be dealt with. As Wambach observes, these categories are conceived of as being dynamic and subject to amendments, yet as they must be democratically sanctioned, they can never be as adaptable and fast moving as the rating agencies on the stock exchange.

In what is currently seen as a healthy economy, money moves about in the form of credit, with loans being issued by banks who thus create new money. If too much is lent, inflation arises and interest rates must be raised to slow the economy down. Nevertheless money is lent and ideally matches the rate at the economy grows so that whilst inflation is avoided, it becomes imperative for the economy under consideration to grow continually in order to remain the same. Conversely if interests rates are too high, stagnation and the danger of a recession sets in, necessitating a reduction in interest rates. Were everybody to suddenly stop spending money and start saving, a recession would likewise be precipitated. Credit and loans are thus the result of a package of beliefs and expectations that a bank has decided to endorse and back with money that wasn’t there before. That this can be problematic if responsibility and common sense are abandoned, is shown by the 2007 crash. In the film The Big Short, director Adam May tells the true story of a number of investment bankers who, realising that the mortgage system had grossly overreached itself, betted on a crash and made a lot of money. The interwoven stories are told at a break-neck speed that reflects the manic, out of control nature of pre-2007 financing.

Nevertheless, lessons have been learnt and rating agencies no longer give ratings without conducting careful examinations. This applies equally to environmental ratings, with green washing being quickly seen through and rated accordingly. As people realise just what a desperate state of the environment is in and the message slowly sinks in of the absolute necessity of reducing CO2 emissions if we are to have a future, the attitudes of banks will change and attention will become increasingly focused on the environmental aspects of any project that is to be backed with a loan and the same will apply to the attitudes of investors on the stock exchange. With respect to insurance companies, who effectively pay for climate change by issuing pay-outs for the damage caused by storms, hail flooding et cetera, attitudes already have changed and insurance companies are already refusing to insure companies that do not have convincing plans for reducing their CO2 emissions and enhancing sustainability. Banking is as it is today, because it and thus we, are solely interested in money and profit, this being ultimately based on an exploitation of people and the environment. Slowly however, the focus will shift and credit and loans will be based not only on monetary considerations but also on sustainability and the attaining of zero carbon emissions and thus, at the end of the day, on the regeneration and saving of the natural world, as opposed to its destruction. Although politicians can tamper with agreed targets and deadlines, as awareness of what is at stake increases and people understand the mechanisms that have been set up to counteract what has been happening, the opportunities for tampering decrease. To reiterate, at the end of the day it is we and our attitudes that underwrite banks and the criteria according to which they issue money, with the same applying to politicians and the national debt. The upshot of this is that if we genuinely want to change the world, we must change our habits and the way we think. In an environmentally aware and informed world, as the zero emissions deadlines approach, on the FTSE, the Dow Jones and the DAX, Herrmann sees swathes of stocks and shares dropping in value and becoming valueless, as obsolete industries, such as the airline industry, go out of business and others such as car manufacturers and chemical companies, reduce production and downsize. Despite the fact the transition from capitalism to green de-growth will result in the loss of millions of jobs, millions of new jobs will come into being, offering Herrmann claims, more than enough jobs to cover those lost in obsolete industries. Houses will need insulating and fitting with heat-exchangers, decimated forests will need replanting and the management of water will become paramount. Green packaging will boom, with plastic being replaced by glass, paper and cardboard. Glass receptacles will become standardised and re-used and only re-cycled when no longer useable. Across the world, cities will need sea-walls to protect themselves from rising sea-levels, resulting in huge building projects. All this will be paid for through the creation of new money backed with green promises and believed in by a people who are willing to work for and towards a green future without economic growth – for the simple reason that this is the only future available. As before, the new money will be created by governments increasing their national debts and through banks lending money to back green projects. Meaning what it says, green de-growth will result in a loss of productivity. In Germany, Herrmann sees a reduction of at least 30% being necessary in order for a zero emissions status to be achieved. Taking a drop in productivity of 50% as an extreme case, she observes that this would still result in a degree of prosperity comparable to that of 1978, when it was perfectly possible enjoy life to the full without undue cares. As no one is betting on a future lined with gold, banks, insurance companies and all manner of financial service will lose their trump cards – the borrowing and lending of money. In this way, although banks have a key role to play during the transition, once green de-growth has been achieved they will find themselves largely out of work as credit and loans become unnecessary. Only mentioned once in Herrmann’s book is that in the new economy, wages will be significantly reduced with it being easy to see that it will be the absurdly high wages of today’s managers and the handsome salaries of middle management that will go. This is also the position taken by Lisa Herzog who sees people in the future, as working in high positions for the challenge, respect and responsibility that it brings rather than for the money which will according be reduced. Just as money today is invested so as to make more money, so much work done today is unnecessary and is done so to generate more work and so keep people in employment despite the under-cutting effects of machines and technology. As all these superfluous jobs vanish, Herrmann sees work in the future as being less stressful, without the cut-throat aspects that characterise the modern work-place and with it being possible for people to work less – this being something that many people will take advantage of. Once green de-growth has been established and emissions are down to zero, Herrmann sees growth as being able to make occasional come-backs but never in a way that will incite a frenzy of quantified betting on the future. Instead of growth dictating how much nature is to be left un-destroyed, it shall be nature that decides how much growth is to be allowed. The turbo-driven nature of the stock-market calmed, instead of betting on a vision of the future replete with promises, investments will be in ensuring that the future remains the same as the present with the goal of zero emissions either in place or being reduced further.

In the context of how we are to change our ways, Herrmann raises an additional point that is absolutely fundamental. Again referring to the British war-time economy, she observes that the system of rationing operating in Britain, although designed so as to ensure that no one starved, as everyone got the same, also had the effect of bonding people together so that a culture and form of commerce was created that was concerned not with the production of the superfluous but with the production of what was important. Yet in contemporary society the opposite has become institutionalised and dreams are peddled that those with the right gadget, the right education and the lucky touch, will streak ahead, distinguishing themselves from the rabble they leave behind. Further education becomes all-important, with the implication being that at the right institution, the wisdom of a life-time can be acquired in just a few years. Through use-fixation and the mania for quantifying everything in order to master things, education and knowledge become debased and there arises a superficial culture in which the bottom line is always „I know better“. This enables the lone-ranger in us to ride roughshod over the concerns of others and it is precisely this that hinders the coming into being of a sense of good and bad and the all-important sense togetherness that is needed if the transition from capitalism to green de-growth is to be achieved. Accordingly, a huge cultural shift is needed if the cynicism that lies at the heart of contemporary society is to be replaced with neighborliness, honesty, humility and a will to co-operate, join in and help. Meanwhile on an intellectual level, the will to know and master, regardless of whether for mastery’s sake or that we may outshine others, must be replaced by a genuine desire for understanding of how things work, based on humility and reverence for the world of people and things around us. As we work towards green de-growth, instead of working for ourselves and against nature, we will learn to work with nature. This is the opposite of the exhortation given in Genesis, I, 28 that humans are to lord over nature. Taking this as a leitmotif, in The Subjugation, the Beginning and the End of Human Rule over Nature (currently only available in German), Philipp Blom provides a biography of an idea that if we do not jettison it quickly, will lead to our downfall.

Ulrike Herrmann sees capitalism as something that, not necessarily inherently bad, has nevertheless past its time. Taking a more critical view is Kohei Saito, who in his, Capital/Marx in the Anthropocene, Towards the Idea of De-Growth Communism, calls attention to the fact that capitalism works by externalising its problems. Initially this takes place by creating a class society in which the lower classes are exploited. With the establishment of the supposedly classless societies of the 1990’ies, externalisation was shifted to people on the other side of the world. Other mechanisms of externalisation are the ignored production of toxins and the callousless with which the environment is treated and a dis-regard for the world that we leave to those who come after us. Externalisation also includes ourselves, with personal development all too often being geared towards helping us cope with stress, higher workloads and not necessarily wanted responsibilities. This form of externalisation puts into context the attitude taken to the self by philosophers over the course of the twentieth century: the self is nothing but an irksome oddity that must be explained away as an illusion and denied any form of metaphysical reality. In economics, this results in a cold and sterile model of human behavior that has nothing to do with real people. Accordingly this is the issue addressed by Lisa Herzog. Meanwhile for Alexander Curtis the postulating of a credible model of self with a built-in sense of good and bad is a key concern. For Saito, externalisation is inherent to capitalism and somewhere, someone or something is always being exploited. Accordingly, unlike Blom and Herrmann, Saito sees capitalism as beginning in the sixteenth century, when in Britain, communally held land, „The Commons“, was privatised and taken over by land-owners.

Herrmann arrives at the idea of de-growth through the inconsistencies of the alternatives. Saito endorses this but his arguments are further informed through a new re-reading of the later writings of Marx. For Saito, in the Communist Manifest, Marx doesn’t question the idea of perpetual economic growth and is not concerned with environmental sustainability. Rather he was concerned with how wealth is to be distributed. Following this period however (1840 to end 1850’ies), he became aware of the environment and of the way that externalisation created a rift between man and nature. Following Saito, Marx saw the natural world as consisting of endless cycles in which the products and by-products of processes eventually return full circle. Thus a spawning salmon swims upriver. Laying its eggs, it then returns downriver and at some point dies. Washed up on a river bank, it is eaten by an animal. The animal produces excrement with nutrients that are absorbed by a tree. The tree produces leaves which in the autumn are shed. The leaves are blown into the the river and are devoured at various stages of decay by various organisms. These in turn are eaten by small fish, including young salmon. Marx saw that capitalism disrupts such cycles, with profit being greedily syphoned off, whilst the negative impacts that pay for it, are externalised, „out-sourced“ or simply ignored. Thus during the 1860’ies, Saito sees Marx as working towards a form eco-socialism in which there was both economic growth and sustainability. During the 1870’ies and 1880’ies however, he saw that perpetual economic growth and sustainability were incompatible. Accordingly, he worked towards the development of what Saito calls „de-growth communism“. To this effect, he studied natural sciences and was interested in societies where property was managed communially and without private ownership. He was further aware of the debt owed by the West to the southern, colonised countries (that are are now colonised by multi-nationals and through globalisation). Saito is co-publisher of the Marx-Engels-Gesamtausgabe (MEGA) in which all of Marx’s writings are to be published. This is hugely significant as so far overlooked, unknown material is brought to light. This in turn shows how Marx changed and revised his ideas, these revisions not however being taken into consideration by Engels who was responsible for the publication of the second and third volumes of Das Kapital. Thus throughout the twentieth century, Marx has been seen in a simplistic, false light. Saito thus has bones to pick with both left and right-wing theoreticians. Although for the argument that de-growth is the only desirable alternative to capitalism, it not essential that it should have been arrived at by Marx, it is significant as a part of the new narrative that we need if we are rise to the challenge of creating a genuinely sustainable culture.

The gist of Saito’s arguments and proposals for de-growth communism is that a wide slate of core human needs must be returned to public ownership. This does not however always mean nationalisation (with clumsy top-down administration) but rather constructions such as co-operatives which are owned and run by workers. Essential sectors that must be in public ownership are for Saito, food production, water, housing and energy. Important for Saito is a return to an economy in which the things which are bought and sold are things which are genuinely needed and not short-lived gimicks. The focus is thus on what is needed and not on the superfluous. Once these are provided for at prices that everyone can afford, speculation on their becoming rare stops and the cycles of greed and fear that are intrinsic to capitalism are broken. Saito cites a number of cases where instead of capitalism providing something in abundance (as promised), it instead becomes a rarity that can be speculated on, with housing and water being but two examples. As in the de-growth economy advocated by Herrmann, in the economy advocated by Saito, people would work shorter hours and have more time for friends and neighbors. In this way, a culture of mutual help would arise and the culture of alienation and cynicism that is a feature of modernism so far would become obsolete. Citing worker’s co-operatives and Fearless Cities, Saito argues for a bottom up revision of society. This is very different to the top-down approach suggested by Hermann. Nevertheless the two are not incompatible. With examples all over the world, Fearless Cities are cities such as Paris and Barcelona where, although the national governments follow Neo-liberal economic policies, civic administrations work against this and find that regionally, they can make very significant differences. Thus in Fearless Cities, school lunches are made using regionally sourced ingredients and sourcing from multi-nationals is forbidden. Although this costs more money, everyone knows that the money spent, stays in the region and is not being spirited away to a multi-national tax-haven so that bonuses and dividends are available for managers and shareholders. In Fearless Cities, cities are seen as being for the inhabitants and not for tourists and measures are taken against both over-tourism and gentrification. In the Barcelona Declaration, the administration has made a clear statement that it is against all form s of business that are based on perpetual growth and a never-ending beating-down of prices. The Declaration also accepts that it is the poorer, southern countries of the world who have lost most to capitalism and gained least, with this being acknowledged as unjust. Fearless Cities are thus networked together so that legal knowledge on how to go about re-claiming privitised resources can be shared. Barcelona has also declared that the world’s climate is a state dire of emergency.

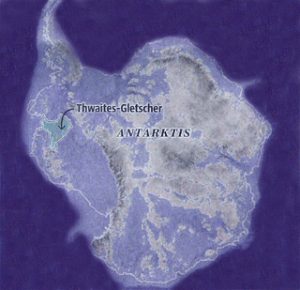

That climate change should be accorded the status of a global emergency, is shown by the fact that recent research has shown that where so far, rising sea-levels have been a result of ice in the Arctic melting, future rises will be due to the melting of ice in Antarctica. This is because changes initiated by global warming, are causing the cold waters that once flew around Antarctica to be joined by warmer streams so that a glacier known as the Thwaites Glacier is now beginning to melt. The size of the British Isles, the melting of this glacier will result in a mean sea-level rise of some fifty or sixty centimeters, possibly by 2100. If we are lucky, this may then stabilise. The absent glacier may well however expose the rest of the Antarctic ice mass to warmer waters, so that over the next five hundred to one thousand years, a rise of some fifty or sixty meters will follow. Initiated by us, if this process sets in, it will be unstoppable. That climate change must be stopped and that we as a species are in a state of dire emergency is thus undeniable.